TCG Global Capital Builder Fund

Performance Track Record

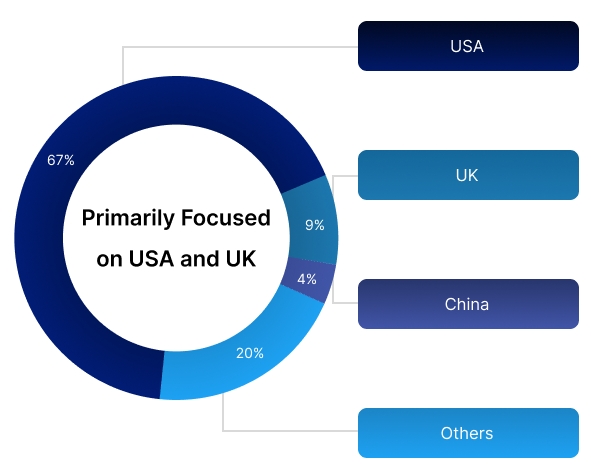

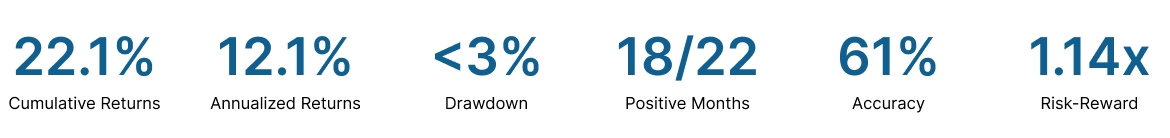

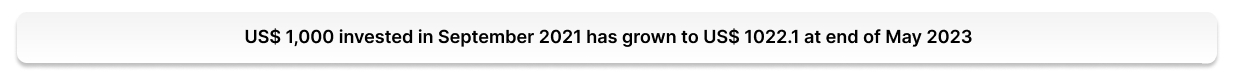

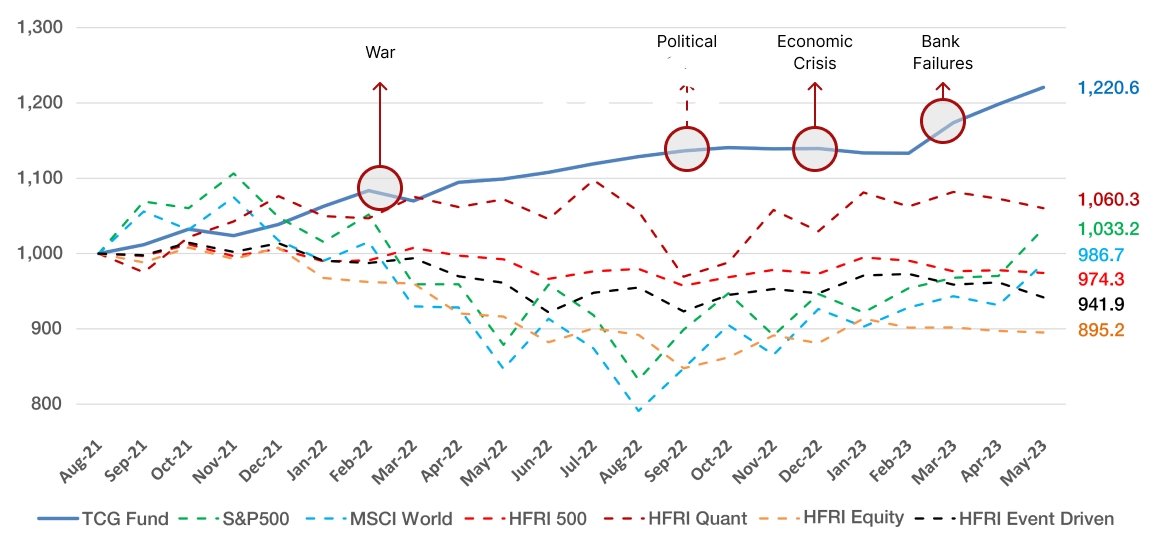

Fund Performance (Sep 2021 to May 2023)

Net Investor Returns (USD) On Invested Capital

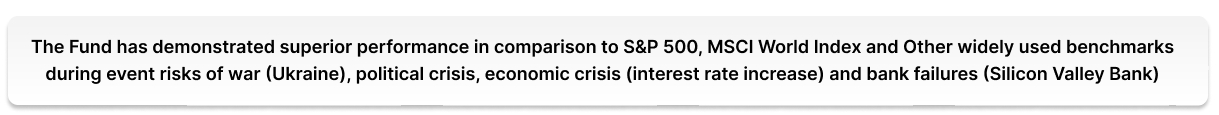

Generated Better Returns at Lower Risk in Comparison to All Major Benchmarks

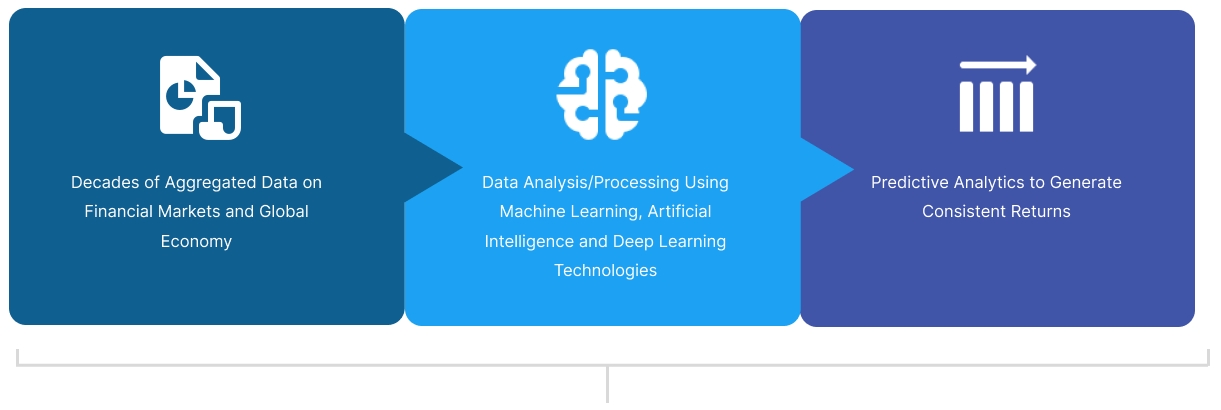

Technology at the Core of Investment Strategy

Driving Superior Liquidity, Wealth Accumulation and Consistent Returns in Leading Currencies.

The Investment Strategies Are Rapidly Shifting Towards Machine Learning/Rule Based Systems

Using “Pure” ML/Rule Based Strategies

Increase in Share of AUM for ML/Rule Based Strategies over Last Decade

of the US Market Cap is held by Tech Driven/ Systematic Strategies

Industry Experts anticipate use of data analytics to become key for creating Alpha (SigTechSurvey 2022)

Source: HFR, Wilmott.com, Aurum, SigTech, Barclays

ML/Rule Based Strategies Increasingly Continue to Outperform

Performance Comparison – Annualized Returns

The ML/Rule Based Investment Strategy out performs every other investment strategy inlisted equities asset class along with MSCI World Index, the global benchmark for listed equities

Performance Track Record

Fund Performance (Sep 2021 to May 2023)

Net Investor Returns (USD) On Invested Capital

Generated Better Returns at Lower Risk in Comparison to All Major Benchmarks

Fund Performance Comparison to Benchmarks

Shariah Series

Addressing Diversification Beyond Sukuks with Higher Liquidity, Lower Duration and Relatively Higher Returns

Offers Investors Stable and Consistent Returns…

An Investment that offers stable dollar/pound returns, flexible maturity and option of any time principal & profits withdrawal-ability

Minimum Investment: USD/GBP 100,000

*Management Fee is accrued monthly and paid quarterly

*Performance Fee is calculated and paid half-yearly

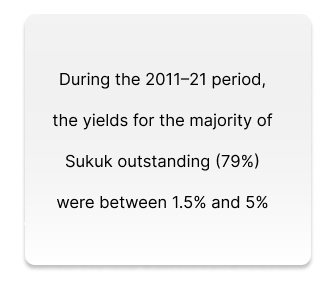

…Delivering Superior Results in Comparison to Sukuks

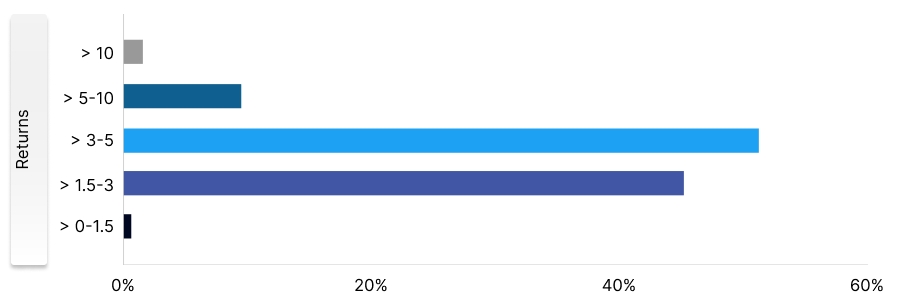

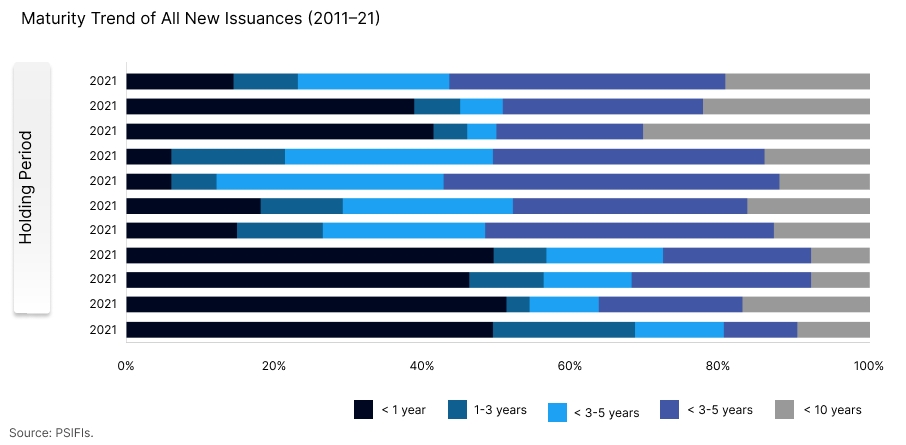

Sukuk Outstanding Volume of by Yield Bucket (%) (2011–21)

Source: IFSB estimates based on data from Refintiv.

TCG Rule Based Investing Leverages Machine Computing and Analytics…

Repetitive Decision Making (Executions) Without Any Behavioral Biases

*Investment strategy and capital allocation is at the discretion of Fund Board of Directors.

Kapil Ahuja

Kapil AhujaHead of Business – India Operations for GIFT City Fund

Mr. Kapil brings a wealth of experience in investor relations and Investment engagement having demonstrated a strong track record with both listed and Private Equity/VC Funds. He also previously contributed his expertise at Fireside Ventures & S-Ancial Global. Mr. Kapil holds a Postgraduate degree in Securities Markets.

In TCG, Mr. Kapil will be responsible for overseeing business development and P&L management for our operations in GIFT City.

.

Mr. Kamlesh Gandhi

Mr. Kamlesh GandhiAdvisor

Mr. Kamlesh Gandhi brings over 42 years of extensive experience in investment banking and capital markets in India. As a former member of the Bombay Stock Exchange for 14 years, he has been associated with prestigious financial institutions such as Centrum Capital Ltd and CIFCO Ltd. He has held board positions in companies like Kirloskar Electric Company, Sundaram-Clayton, and NCL Industries, as well as serving as a director for Dr. Reddy’s Laboratories and The Bombay Store.

Throughout his career, Mr. Gandhi has successfully raised funds for over 320 capital issues, including greenfield projects that later became blue-chip stocks and large business houses in India. His expertise in merchant banking has been vital in advising TCG on investment strategies, consistently demonstrating sound judgment across various market conditions and sectors. His guidance has significantly contributed to the fund’s portfolio strategy, driving long-term success and delivering superior alpha returns for investors.

Mr. Gandhi has also shared his insights as a frequent speaker at the Bankers Training College and has participated in investment seminars in Kuwait and Saudi Arabia, enhancing his influence in the financial community.

Sheikh Essam Khalaf Al-Enezi

Sheikh Essam Khalaf Al-EneziAdvisor

Sheikh Essam Khalaf Al-Enezi, a devout scholar deeply rooted in the rich traditions of Islamic jurisprudence. With a strong academic background and a lifelong dedication to the study and interpretation of Islamic law, he has committed himself to fostering religious understanding and promoting the principles of justice and compassion inherent in the Islamic tradition.

Academic Achievements

Sheikh Mohamed Ali Elgari

Sheikh Mohamed Ali ElgariAdvisor

Sheikh Mohamed Ali Elgari, a distinguished economist known for his profound contributions to the field of economics and his unwavering commitment to global economic development. With a strong educational foundation and decades of experience, he has made it his life’s mission to promote economic understanding and foster positive change on a global scale.

Academic Achievements

Aznan Bin Hasan

Aznan Bin HasanAdvisor

Aznan Bin Hasan, a distinguished scholar in the field of Shariah and Islamic jurisprudence. With a rich academic background and a lifelong commitment to deepening his understanding of Islamic principles, he dedicated his career to the study, teaching, and application of Shariah law in contemporary contexts.

Academic Achievements:

Jicku Jacob

Jicku JacobDirector & Business Head – Middle East & North Africa

Mr. Jicku Jacob is a seasoned professional with more than 2 decades of experience in the financial sector which includes Channel Sales, Distribution & Team Management. He worked with renowned organizations like ICICI Prudential, Allianz, Takaful International etc. His expertise lies in sales, product development, business strategy & execution. His strong leadership skills have helped him build efficient teams and excellent performance. He is a highly result-oriented team player who always goes beyond supporting and strengthening the team.

In TCG, his role encompasses distribution & fundraising, tie up of new alliances etc. in the Middle east, and North Africa regions.

Devi V S

Devi V SSenior Chief Manager – Investor Relations & Operations

Ms. Devi brings over 14 years of extensive expertise in the banking and financial services sector, showcased through her role as Senior Chief Manager at TCG. With a comprehensive skill set spanning branch management, retail banking, credit and risk management, banking operations, trade finance, and compliance, Devi is a seasoned professional adept at navigating various facets of the industry.

In her capacity in TCG, Devi oversees crucial aspects such as client onboarding, investor relations, and operational management, ensuring seamless experiences for all stakeholders involved. Her proficiency in liaising with network partners contributes to facilitating smooth investor onboarding processes, underscoring her dedication to operational excellence and client satisfaction.

Devi’s meticulous attention to detail and unwavering commitment to compliance play a pivotal role in upholding TCG’s standards of service delivery and operational efficiency when it comes to client onboarding and providing service excellence to the investors.

Ashish Raythatha

Ashish RaythathaDirector & Business Head – UK

Ashish comes with nearly two decades of experience in regulated capital markets, having built and scaled digital channels for large institutions in the financial services sector. He has worked with FTSE 100 institutions such as Prudential, M&G Asset Management, BP and the London Stock Exchange in leadership roles. He has developed and executed on business strategies by implementing innovative and transformative initiatives to ensure growth within these businesses.

He is an outcome focussed team player who is motivated to grow people and has successfully led large cross functional teams. He has a clear practical approach to work and has a good understanding of financial markets. He has done his MBA from Warwick Business School and is an alumnus of Singularity University.

In TCG, his role encompasses expansion of distribution, forming alliances with network partners, fundraising and portfolio management in the UK.

Rajeemol GR

Rajeemol GRSr. VP – Corporate Communication & HR

Ms. Rajeemol GR has cross-functional experience of nearly two decades in corporate communication, human resources, investor relations, business support, functions, and sales effectiveness. She has worked in various industries like real estate, insurance & FMCG and has been a part of renowned organizations such as Muthoot Group, Max New York Life Insurance, Coca- Coca. During her career, she has demonstrated excellence in the incubation and implementation of various company-wide processes and policies to drive organizational efficiency. She is highly skilled in managing and effectively communicating with cross-cultural teams in a structured manner. Her expertise in HR functions has led organizations to build a strong workforce which has played a pivotal role in their growth trajectory.

A methodical and diligent professional who is adept at working with complex business scenarios and her expertise lies in finding creative solutions. She has worked with senior stakeholders on strategic formulation, planning, and execution at an organization and business unit level. She has also partnered with business leaders on improving sales effectiveness, driving large recruitment initiatives, key leadership hiring, and execution of critical HR projects. Her role entails consulting TCG’s portfolio companies to streamline their Hire-to-retire process, which includes implementing TCG’s strategic appraisal system, and other key HR policies. As head of Corporate Communication, she ensures consistency in communications and creates the right public perception about the organization. She also leads Investor/ Network Partner Relations across geographies and is a part of the fund-raising team. She has a very strong acumen for building distribution networks and plays a significant role in coordinating fundraising operations.

Core Competencies/ Skills

Corporate Communication / Human Resources/ Investor & Network Partner, Relations/ Sales Effectiveness/ Performance Management/ Fund Raising/Project Management / Team Management/ Operations/ Organization, Restructuring / Change Management/ Leadership/ Policies & Compliances/ Business Analysis/ Strategic Planning/Finance & Accounting / HR Governance/Retention Strategy

Mr. Shubham Gupta

Mr. Shubham GuptaJoint Manager – Investor Relations & Operations

Mr. Shubham Gupta is an Investor Relations professional who has previously worked with Tata Consultancy Services and Royal bank of Scotland where he was looking into end to end Client on boarding process, KYC Operations, Client Query management for New and existing investors. also worked on Trade Settlement, Trade Confirmation, and Reconciliation of funds for Fixed income securities. Shubham is an MBA from Pune University.

Mr. Ranjith Kumar G

Mr. Ranjith Kumar GSenior Director & Business Head

APAC, Middle East and Africa

Mr. Ranjith Kumar comes with nearly two decades of experience in sales and distribution, having built and scaled distribution for large institutions in the financial services space. He has worked with marquee financial services institutions such as ICICI Prudential Life Insurance and Muthoot Group in leadership roles. He has conceptualized and executed complex distribution channels by strategizing innovative business development initiatives to ensure growth in companies. He serves on the Board of consumer and education sector companies. A thought leader and strategist who has the ability to ideate and execute initiatives while working in an unstructured start-up environment.

Highly result-oriented team player who goes beyond his call of duty to support and strengthen the team. He is adept at managing large teams while ensuring that they reach their maximum potential by utilizing his excellent man management skills. He has a clear practical approach to work and has a profound understanding of international and local financial markets. In TCG, his role encompasses fundraising, expansion of distribution, alliances with network partners, and portfolio management. He has an extensive distribution network across India, the Middle East, South-East Asia, and African markets. He is an expert in developing and maintaining investor/ network partner relationships. He has formulated and executed various innovative strategies to start and build new business structures for portfolio companies.

Core Competencies /Skills

Business Development / Sales & Distribution/ Investor & Network Partner Relations/ Fund – Raising / Alliances & Partnerships/ Portfolio Management/Team Management/Operations/Organization Restructuring & Turnaround /Change Management / Strategy/Leadership

Julia Wang

Julia WangAdvisor

Julia Wang, a seasoned investment professional with a passion for navigating the complexities of equity markets, particularly within the dynamic Chinese landscape. With a diverse background and a proven track record in investment management, she has dedicated her career to delivering strategic insights, fostering growth, and creating value for investors and organizations alike.

Professional Expertise

Career Highlights

Monal Gupta

Monal GuptaAssistant Manager – Legal and Secretarial

Monal Gupta has over 10 years of experience and specializes in areas of Secretarial matters, legal, and compliances. She is an associate member of ICSI and has done Masters in Economics and Economics Hons from Daulatram College, Delhi University. She also possesses experience in mutual funds, equity, insurance, and the stock market.

Ms. Lavanya Devi A M

Ms. Lavanya Devi A MSr. Executive – Corporate Communications & Operation

Ms. Lavanya Devi is handling Corporate Communication, IR and Operations for the fund. She holds a B.Com (Hons.) degree from Delhi University and a master’s degree in Commerce, specializing in International Business. She has significant expertise in HR, Admin, Operations and International Client Management and was previously exposed to different sectors like IT, Education and Healthcare.

Mr. Siddhant Minocha

Mr. Siddhant MinochaLegal and Secretarial

Mr. Siddhant Minocha is an Associate Member of Institute of Company Secretaries of India. He is part of the legal team handling the legal and Secretarial Compliances of the fund. Siddhant has previously worked with in the Corporate Secretarial team of Maruti Suzuki India Limited, Tapasya Group and as Company Secretary of Quatrro Global Services Private Limited.

Mr. Uday Uddanti

Mr. Uday UddantiVice President- Operating Pool

Mr. Uday Uddanti has a rich experience of over 9 years with an exposure to sectors like Real Estate, Technology, Material Testing, and Telecom. He is an operating professional at TCG in their Real Estate vertical. He has previously been associated with Accenture and CAMS Systems. His expertise lies in Real Estate Investments, Operations, and Strategy. He is responsible for the acquisition and development of new properties, property selling, and P&L/Cash Flow Management. He is also responsible for sourcing and executing deals.

His strong in-depth knowledge in the real estate sector in Hyderabad has helped strengthen TCG’s real estate portfolio. Uday is a master in implementing TCG’s strategy in the real estate portfolio during the lifecycle of the property. His role entails Sourcing deals, conducting market research, Building financial models, analyzing deals, handling necessary regulatory compliances, and giving recommendations to the fund management on investment. He is closely working with real estate portfolio management for real estate development and sales effectiveness.

Core Competencies / Skills

Business Development/Strategic Partnerships/ Portfolio/Management /Team Management /Operations/Organization/Turnaround/ Sales Effectiveness/ Strategy/ Leadership/ Product Management / Digital Marketing/IT Strategy/ Problem Solving/Program Management / Negotiation / Communication / Analytics/ Real Estate Regulatory Compliance

Mr. Ashwin Kumar

Mr. Ashwin KumarChief Operating Officer

Mr. Ashwin is a highly qualified professional who is the Chief Operating Officer stationed at TCG’s Bahrain desk. He is a high end banker with across-the-board proficiency of 18 years with Standard Chartered Bank, Kingdom of Bahrain, handling only HNI and UHNI’s relationships in the Priority Banking Division. He holds an MBA from the University of Bangalore. He began his career with Standard Chartered Bank, the Kingdom of Bahrain in Investment, Wealth Management, and Cash Management (Corporate Bank) sector.

He has vast expertise in investment yields, such as CASA, TD, Fixed Income Securities, Structured Investments, Mutual Funds, Equities, Wrap Products, Structured Deposits, Insurance and Derivatives. His knowledge of bestowing Leverage, Overdraft, Mortgages, and Personal Assets are one of a kind. He also has experience in handling UHNI’s relationships and mining valet shares.

Ms. Wanhsi Yeong

Ms. Wanhsi YeongTechnical Partner

Ms. WanHsi Yeong is experienced and knowledgeable in deal origination, execution, and closing, and is skilled in negotiating the regulatory, legal, and compliance intricacies inherent in transactional structuring. With 15 years in cross-border work in the ASEAN and greater Asia area, she understands the complexities of constantly developing market practices, and has deep knowledge of execution processes. She is a family office practitioner and registered as a member of the Global-Asia Family Office Circle (GFO Circle supported by the Singapore Economic Development Board), and the Monetary Authority of Singapore (MAS).

Her expertise lies in private wealth, financial services, fund management structuring, family office work (including soft management skills for Family Office clients), Corporate, Securities and Capital Markets, and Fintech work. She also has over a decade-of-.experience in social responsibility work. Her role in TCG involves identifying suitable deals in the private equity, family office, and funds space, assisting high net worth individuals and families in the creation and structuring of fund structures, succession, legacy and wealth planning, and business growth

Core Competencies / Skills

Deal Structuring and sourcing /ASEAN, Asia Network/ Corporate Finance/Securities/ Family Office/ Compliance, Regulation, & Advisory SG centric incentives and tax schemes Alliance and Partnerships/ Legacy and Succession Planning

V C Vinod

V C VinodPartner – Governance Services

Mr. V C. Vinod brings to TCG decades of experience as a counselor and advisor to family-run, businesses and HNIs on the important subject of ‘Inter-generational Wealth Transfer’. It has been his experience that the challenges are almost always of ‘human’ nature as opposed to legal or operational ones. Vinod’s unique expertise lies in helping clients address the ‘philosophical questions’ as a first step. Once that is done, he actively supports them to form ‘family councils’ and then establish the ‘rules of engagement’ of the council. He also acts as a respected ‘mentor’ to the younger members of the family.

This helps him in minimizing conflicts and better resolve them when they occur. Vinod has extensive experience working with families from Switzerland, Germany, Austria, and Liechtenstein. Being of Indian origin and having lived in London, the US, and the Middle East, Vinod is uniquely placed to assist clients of the Indian diaspora.

Ms. Elizabeth Tay

Ms. Elizabeth TayDirector – Investment Services

Ms. Elizabeth Tay Poh Suan is a seasoned Private Banker. She has rich banking and financial services experience with Bank of America private banking in the ’90s, UBS from 2000 to 2008, Deutsche Bank from 2008 to 2013, and Royal Bank of Canada from 2013. She built and managed portfolios of wealth management clients who were mainly Asians, known them for many years, and are the first and second generation. Her expertise lies in close banking relationships with her clients.

Based on her assessment of their needs and risks profile, Elizabeth worked closely with the bank’s Investment Team to create and enforce investment ideas hence initiating an appropriate portfolio according to their risk appetite. She also worked in partnership with the sales team on new sales and cross-selling opportunities for prospective clients.

Being a MAS-regulated private banker, Elizabeth has attended and participated in various relevant courses organized by the Institute of Banking financial institutions (IBF), as well as all the in-house mandatory banking programs in financial institutions she had worked previously. Her role in TCG as a member of the Investment Team for the Singapore Fund structure is to support the management of the organization when the need arises; to keep abreast of TCG’s product offerings and be aligned to the organization’s value as a representative.

Core Competencies/Skills

Private Banking / Wealth Management/ ASEAN, Asia Networks/ Portfolio Management/ Sales Operations/ Investment Judgement/Investor Relations Leadership/ Business Development/ Risk Management

Mr. Sherroy Ong

Mr. Sherroy OngTechnical Partner

Mr. Sherroy Ong is a well-seasoned structured, and successful advisor and closed many deals in his career in the financial world for the last 20+ years. He is also well-versed in the regulatory landscape and able to maneuver every step of a transaction (especially in liaising with the regulators in Singapore). He is also a family office practitioner and registered as a member of the Global-Asia Family Office Circle (GFO Circle), supported by the Singapore Economic Development Board (EDB) and the Monetary Authority of Singapore (MAS).

He is also focused on ASEAN and greater Asia cross-border work and familiar with the “rig morrows” /”nuances” of a particular transaction in a particular country. His expertise lies in Private Wealth, Financial Services, Fund Management structuring, Family Office work (including soft management skills for Family Office clients), and Corporate and IP services work. His role in TCG involves identifying suitable deals in the private equity, family office, high net worth individuals, creation and structuring of funds, and using Singapore as a springboard for wealthy clients to set up their global operations and “connect the dots” on the myriad of FTAs that Singapore has to offer to global family office businesses to the world.

Core Competencies / Skills

Deal Sourcing/Deal Structuring/ASEAN, Asia Network/SG centric incentives and tax schemes/ Corporate Finance / Regulation and Advisory/ Alliance Partnerships/Family office/Succession Planning /Trust Planning/ “Connect the dots” /Value Creation

Mr. Chandan Kumar

Mr. Chandan KumarPartner

Mr. Chandan Kumar is an experienced Investment Professional, having worked for more than twelve years in Private Equity and Venture Capital. He previously worked With Baring Private Equity Partners India. He has handled multiple investments and exit processes including deal sourcing, deal evaluation, due diligence, and legal agreements across sectors such as Technology, Financial Services, Real Estate, Media, Chemicals, Automotive, Agriculture, Logistics, and Infrastructure.

He has also played a critical role in the operating management of portfolio companies and has significant experience in managing various functional areas including strategy, merger, and acquisitions, P&L management of specific business units, corporate finance, alliance management, and sales & marketing. He serves on the board of several companies in real estate and wealth management sectors.

His expertise lies in Deal Sourcing, Deal Evaluation, and Investment Judgement. An analytical mindset combined with strategic thinking, his strength lies in devising and implementing creative investment strategies. Meticulous attention to detail, ability to think critically, resourcefulness, and an execution-oriented, positive attitude are key attributes that he possesses.

His role in TCG involves ideation and identification of new investment opportunities in key strategic sectors/investment themes, investment evaluation, and execution of investments and exits, While also playing a value creation role with portfolio companies steering them toward maximizing profitability and margin expansion. His extensive experience in the Private Equity and Venture Capital sector has been instrumental in developing differentiated investment strategies for the firm across multiple asset classes. He is also involved in business development and hiring for leadership roles for the firm.

Core Competencies/Skills

Deal Sourcing/Deal Evaluation / Due Diligence/ Investment Judgement/ M&A /Investment Negotiation & Structuring/ Corporate Finance/ Business Valuation / Financial Modelling/ Business Development/ Portfolio Management/ Margin Expansion/ Strategy/Corporate Governance/ Sales Operations/ Alliances & Partnerships/Buyside Expertise

Mr. Punyashlok Bhakta

Mr. Punyashlok BhaktaPartner

Mr. Punyashlok Bhakta is a seasoned private equity investment and operations professional with more than 22 years of experience in strategic roles across investing, building and scaling consumption-based businesses in various industries. He has served blue-chip companies such as Asian paints and L’Oreal in leadership roles. He has held various roles spanning across marketing, product development, and business strategy & execution. He serves on the Board of several companies in the consumer goods, value chain, and digital sectors. His strong leadership skills have helped build strong teams and ensure projects/ initiatives are always performed successfully.

He is highly skilled in Portfolio Management and Business Strategy. Excellent communicator, capable of translating complex business objectives into actionable KRA/KPIs across verticals. His operational strength lies in new strategy execution, production in the consumer space, and networking. His expertise in valuation, due diligence, integration, driving corporate change, and sales excellence, enables creating and maximizing value.

His role in TCG involves identifying acquisitions and devising turnaround/ margin expansion strategies for portfolio companies. His deep understanding of marketing and product development has been critical in driving innovative product offerings across portfolio companies, especially in the FMCG sector. He is also driving business expansion across multiple asset classes and a key member of the hiring committee for leadership roles and developing winning strategies for portfolio companies.

Core Competencies/Skills

Brand Management/ Product Design & Development/ Digital Media/Online & Offline Marketing / Business Development/ Fund Raising/ Investor Relations/ Buy Side Expertise/ Investment Judgement/ Portfolio Management / Innovation / Strategy/ Leadership / Margin Expansion /Organization Restructuring & Turnaround/ Buyout/ Sales Operations/ Process Excellence

Mr. Stephen Weil

Mr. Stephen WeilAdvisor

Mr. Stephen Well has a strong international corporate finance background, over 30 years, focused on delivering growth and good business across the globe for clients, employers, and colleagues; and structuring international partnership and joint venture deals for clients. He set up his own business in 1990 to provide specialist advice and expertise to grow businesses seeking to develop new markets in Britain, Europe, and North America. His business has grown into one of Europe’s top business practices focused uniquely on supporting clients’ growth internationally through partnerships, joint ventures, alliance management, and new market entry services.

He is a Non-Executive Chairman in an e-commerce marketplace. He has specialized in winning and delivering advisory mandates, particularly in cross-border technology, real estate sectors, media, and financial services. His expertise covers M&A, New Issues on the Stock Exchange, and Private Equity Funding. He has extensive experience in opening new markets while retaining the openness of a team from diverse national and professional backgrounds.

His expertise includes SEIS Investment/ EIS Investment, Crowdfunding, Angel investing, Start-ups, Market entry strategy, Partnering, and specialist in corporate finance advice. His extensive industry and governance experience along with a strong network enables TCG to significantly expand its global reach and outlook. His advice helps the team in building a strong global ecosystem encompassing areas of fund management, investments, operations, and consulting.

Mr. Moyez Alibhai

Mr. Moyez AlibhaiAdvisor

Mr. Moyez Alibhai who is based out of Nairobi has extensive experience of over 35 years in starting, acquiring, and building businesses and corporate governance. He is the Chairman of the Aga Khan University Council Kenya, Aga Khan Health Service Kenya, PDM (a long-established property manager and developer), and Capital Club East Africa.

Mr. S. Sathyamoorthy

Mr. S. SathyamoorthyAdvisor

Mr. Sathyamoorthy’s career trajectory of 54 years has expanded his extramural horizons. Qualified as an Arbitrator, Elected as Honorary Executive Director of Anti-Corruption Academy of India, Appointed Director in Pasupati Acrylon Ltd, Chaired APS Management Consultants (P) Ltd, became Management Trustee of Chennai Age Care. He has specialized in Banking, Economics, Auditing, and Accounting. A qualified civil service professional having served in prestigious roles in the Indian Government. He has served in the ministries of Government of India and in the offices of the Comptroller and Auditor General of India.

During his tenure, he gained exposure and experience, particularly in the Ministry of Shipping, and Ministry of Human Resources. Mr. Sathyamoorthy led the Indian Delegations to Singapore, Greece, Hungary, Italy, Germany, Turkmenistan, and Peru. His creative writing blossomed into 17 books and a weekly column for ten years. He has delivered several professional lectures, participated in international conferences, and acted as a Brand Ambassador, in addition to the many roles he has held during his professional journey.

Mr. Sathyamoorthy’s rich experience in SEBI regulations, Alternative Investment route, Company Law Prescriptions, and CSO’s has helped TCG to strengthen their fund and portfolio compliance regulations. He has addressed potential investors in Kenya, Dubai, and Australia to name a few, and met with, Judiciary High Ups, IPO experts, International Bankers, and Medium Sized Entrepreneurs in the private sector

Mr. Vikas Talwar

Mr. Vikas TalwarLegal and Secretarial

Mr. Vikas Talwar true to his last name is as assertive as the sword when it comes to leadership. He is TIW’s legal & secretarial head. He holds a LAW degree under his belt, a BCOM graduate, and A CS certification by the Institute of Company Secretaries. His skills are wrapped around secretarial work, corporate governance, joint ventures, corporate law, legal compliance, intellectual property, auditing, and mergers & acquisition. He has several years of experience working in leadership roles as general manager or secretary head for NIIT Smart Serve, Escosoft Technologies Limited, Quatrro Global Services, and Quatrro Mortgage solutions. Vikas continues to play an important role handling all legal affairs and compliance with TIW.

You must view and understand this page as the usage of this website is crucial to the following details and conditions of terms. After you have reviewed and understood all terms you may proceed and click on the I agree to verify that you have read and comprehended and even agree to these terms which form a binding legal contract between us

You must agree to abide by all terms on every occurrence that you use this website whether you are a professional client and/or a market counterparty under all the rule books lawed down by the Dubai Financial Service Authority (DFSA) and are not any person of a foreign resident in or having any registered offices either in Greece, Poland, Latvia, Italy France or Spain. and following in compliance with every law and regulation such as that of the jurisdiction within your country in which you are staying. In case you do not agree to any particular terms then please refrain from using the website completely.

I hereby agree and ensure that I am a proficient client or a market counterparty beneath the rule books associated and governed by the Dubai Financial Services Authority and in no way am I a person denizen in a registered office in Poland, Spain, Latvia, Greece, or France. I am accessing this website in adherence to the laws and regulations of the government or country in which I am living

In these terms, any reference with ‘you and you’re’ are direct concerns to any person utilizing or accessing (endeavoring to use or supplements) unless otherwise express your in terms refer to the meaning of such representations in the individual rules and ordinances of the applicable jurisdiction this website and knowledge within is demanded only at and includes data about products and services that are only obtainable to those individuals who are the professional clients and market counterparties as described in the business instance of the rule books governed by the Dubai Financial Service Authorities (DFSA) and two reports the website may lawfully be directed in any relevant jurisdiction of experienced client and market counterparty can be seen on DFSA. This website is not staged at or made available to individuals that are not investors or any retail clients in the Dubai International Financial Centre the is DIFC or any individual residency in or holding a registered office within Poland, Greece, France, or Spain. If you are any suspicion as to your status you can consult a monetary advisor or contact us directly. In addition to the overhead, this website and the details withholding is not mandated or addressed to any individual of residence in a particular territory of our nation such distribution would be an agreement as per local new law and restriction consequently all individuals who have access to the website any such.

Restrictions:

TCG and its associated parties disclaim all obligation if you review or download any data from this website in infringement of any law or statutes in the country of which you are a national of which you are living or habituated. Statements on the website the facts on the website are issued by the ECG absolute liability companies having their residence to Dubai, Singapore & India. With a connection in 27 countries as well. The information includes specific alternative asset funds which may be managed or declared, and promoted by TCG and associated third-party companies the knowledge is not mandated to any individual in any jurisdiction area where it is unlawful to seek, open, and use data

This website and the data are furnished for information objectives only and do not comprise a publicity invitation of solicitation to pledge in any investment movement containing to buy a cell any investment or any welfare in the funds or a hype offering of stations of a unit of claims in the fund

Moreover, any conceivable future publicity invitation presents a solicitation to pledge in such investment action or any possible prospective buildup offering of a sequence of units of stake in the funds will only be completed by each individual. TCG and it is in adherence with their separate applicable commonness regimes to the categories of person that each probe individual TCG commodity may transact within the magnitude formatted by the relevant regulatory provision

The TCG capital group of companies comprises TCG acquisitions which are restrained by the DFSA which is controlled by the Financial Service Commission and TCG management were Singapore, India & Dubai suitable references in these terms or any respective. TCG may include a connection to the appropriate company or commodity within the TCG group according to the context.

Restriction:

On admission to this website by investors who are in the United States, the data is not mandated to any person in the United State and this website is not planned to use by any individual in the United States unless those individuals are already investors in funds and they have the relevant United States governing the exemption of any kind.

Password:

We may equip you or the concerned party with a username and password to admit certain details included in the website you must minister access details as intimate and you must not reveal it to any third party or allow any third party to enter this website utilizing your username or password if so you must agree to notify us instantly if you reckon any unauthorized usage of this website or any fraudster using your username or password. We accumulate the right to decline your access to password-protected data or instantly discontinue or terminate your entrance to this website or maim any username or password whether chosen by you or provided by us at any time.

No Recommendation:

This knowledge is supplied for communication purposes only and because you shall make your investment judgments. TCG is not soliciting little or any movement based on the knowledge the details if not taken to account of your respective investment purposes of financial position the details do not comprise and should not be completed as investment guidance or a personal suggestion to buy or sell or otherwise transact in any asset including the reserves unless individually and communicate investment direction. MiFID investment usefulness and actions for users for any of these websites.

By this website, no one shall or is a plan to comprise financial legal accounting of any tax advice. The funds guided within this website may also not be appropriate investments for you, therefore and you should always adhere to skilled investment advice before deciding to invest in any type of fund.

Risk Factors:

Warnings for clients or investors for any investment affect substantial risk as the offer records to each fund include risk warnings that are specific to the applicable fund. Hence you should consider cautiously before taking any judgment to invest in the past performance is not a dependable indicator of how it will affect future performance the value of an investment and the revenue from then on can go up or down. Investors may also not get back to the portion originally invested and could lose all of such investment.

Exchange rate differences may cause any currency value of investment to increase or decrease based on all the levels. It is important to note that taxation may change to the period that any details on this website refer to a special tax treatment such decisions depend on the individual events or investors and is subject to change in the fortune the checklist of risk factors must be well read by the prospectus and the latest financial information and offering documents for the relevant fund.

No disadvantage the information including any phrase of the opinion of the forecast has been received from and or is established on references believed by TCG to the trustworthy but is not insured as to its precision validity or absoluteness report is present only as today it is first published and could no longer be accurate or whole when reviewed by you thought express or conveys the thoughts of TCG at the date of posting and may only reflecting predominant market prerequisites and specific hypotheses which may also not prove to be useful and a subject to modification and should not be depended on by uses of this website to edit this website regularly.

The knowledge is provided as no expression warranty or interpretation is given as to the precision validity or fullness of the information by TCG Capital Group and its associate parties or any of the individuals, directors, officers, employees, agents, and partners. This is tolerated by such person for the accurateness validity or totality of such reports. Any person who views these reports and changes his/her investment function in consideration of the data does so at their own risk.

To the precise governance by law, TCG is linked to companies and such respective, employees, agents, partners, officers, or directors. This condition warrants associates and other such restrictions and terms which might be implied by statute and compliance of the governing common law, the law of financial equity, etc. TCG and associates in such case are not obligated or liable for any damage, loss, or to any person for a direct or indirect association for any consequence with the investors.

This website and any such data linked or connected with any direction or hyperlink are not to be considered entirely accurate and any business interruption or law in a such case related to data etc does not enable the user to hold TCG liable for any kind of damage. This is to be noted to fall under the regulatory system which is limited to compliance and governance by the DFSA.

Should be noted that the internet is a place filled with a balance of information that can be accurate or false and hence should not be trusted as a reliable and effective medium to make judgments on funds and transitions. In such a case, TCG will not accept any liability when it comes to transitions on investing errors. This also includes confidential data. We advise the user to make proper judgments at their own risk.

Indemnity:

By entering this website, you further agree to indemnify further and holders TCG and its linked companies and licensed directors, employees, financer, employees, and agents. This will also include no liability for any legal laws and fees. Officers, directors, partners employees and agents of TCG and are associated company from any against any claims liabilities damages losses or expenses including legal fees and costs arising out of any way connected with your access to this website or use of information.

Copyright, Trademarks, and Other Rites:

Copyright trademark and other database rights hold patents and all similar liberties and the information that is contained or governed by TCG which includes ownership shall not in any way be used to reproduce, copy information, or otherwise be manipulated for personal use. In such a case, TCG owns distribution and copyright ownership and can be considered an illegal activity liable as a penalty by law.

Amendment:

TCG owns the rights to delete, edit or make changes on the sites or terms without the effect of request or notifying the user. In such cases, it is also advised for your to carefully read and accept the new terms. Failure to do so may immediately permit TCG to cancel or revoke your access to the website, login iD password, etc. This is by the court’s jurisdiction and legality.

If you agree to all the terms and do not dispute any such compliance referred in the website terms without any such obligations arising from the local laws. As you accept you may proceed to click on the I agree button and use the website.

Privacy Data Policy, Protection, and Cookies:

TCG is dedicated to utilizing appropriate steps to encourage procure the safeguarding of the private information which you may furnish through this website. TCG will hold it confidential under relevant data protection laws in the matter of data held by TCG capital group with such information in held in non-violation with the data security law 5 of 2020.

To achieve certain Fossil input details about yourself about your name, address, telephone number, email address particulars, and any other details connected with TCG customer regulation process this data for the administration and service of investment and other connected activities and guarantee compliance with its commitment under DISC regulatory.

You agree that TCG has the privilege to use and so such data on its internal strategy and to transmit it to associated companies if relevant whether inside or outside the area to deliver services to you should be conscious that the level of security and regulation to the processing of confidential data may not be the same in all nations. TCG will ensure that we enforce appropriate protection in line with relevant data protection laws.

Please refer to the client notice with collections out how we will process your data. Note that you would need to accept all cookies which is a piece of information that is preserved by your computer hard disc, or by the web server, or the mobile device for more facts you can also visit Google analytics.

Session monitoring is the use of application software that records your sessions on our website. This application will document the internet protocol address used by you. The website will also capture the data you viewed, your inquiry, and the time frame. If you need any further clarification or inquiries about this website or any other information, feel free to contact us via email and we will get back to you ASAP.

TCG Partner Program

Advisor – Investments

Dr. Rabi Narayan Bastia needs no curtain-raiser in India and is also recognized globally for his contribution as a scientist. He has been celebrated and cited by the Indian Geoscientist and Padmashree awardee for his discovery of Natural Gas at the Krishna Godavari Basin, in the Bay of Bengal in 2002. He got his degree of Doctor of Science (DSc) from the Indian School of Mines, Dhanbad, with his thesis validated by Alberta University and the University of Oklahoma. He received the Gold Medal of the Association of Exploration Geophysicists. He has also been featured in who’s who in the American program and still holds several awards and recognitions for his discovery and advancement in petroleum. TCG is honored to have him on the advisory committee member to impart valuable advice and assessments on business strategies and investment plans to increase investors’ wealth.